Through the 2020 tax year the federal government offers the nonbusiness energy property credit.

Solar energy credit 2019 irs.

The residential energy efficient property credit and the nonbusiness energy property credit.

Also use form 5695 to take any residential energy efficient property credit carryforward from 2018 or to carry the unused portion of the credit to 2020.

This is known as the residential renewable energy tax credit.

Use these revised instructions with the 2018 form 5695 rev.

Filing requirements for solar credits.

Taxpayers who upgrade their homes to make use of renewable energy may be eligible for a tax credit to offset some of the costs.

To claim the credit you must file irs form 5695 as part of your tax return.

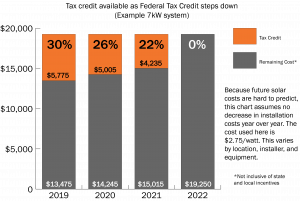

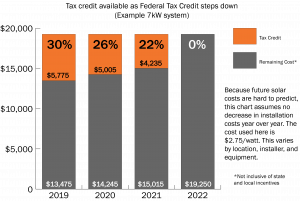

The federal solar tax credit also known as the investment tax credit itc allows you to deduct 26 percent of the cost of installing a solar energy system from your federal taxes.

Information about form 5695 residential energy credits including recent updates related forms and instructions on how to file.

These instructions like the 2018 form 5695 rev.

You calculate the credit on the form and then enter the result on your 1040.

1 48 9 k to be included in calculating the energy credit when adding a new roof and solar panels to the property.

For commercial solar energy under sec.

The residential energy credits are.

In 2018 and 2019 an individual may claim a credit for 1 10 percent of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year subject to the overall credit limit of 500.

Who can take the credits you may be able to take the credits if you made energy saving.

Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit.

Claim the credits by filing form 5695 with your tax return.

The itc applies to both residential and commercial systems and there is no cap on its value.

When filing your taxes for tax years 2019 2020 and 2021 take note of the adjustments that happen.

48 one may reasonably assume that the irs would take a position consistent with letter ruling 201523014 and only permit the incremental costs as defined in regs.

The renewable energy tax credits are good through 2019 and then are reduced each year through the end of 2021.

However these credits will only apply to home modifications made through the end of 2021.